- Išsiųsime per 10–14 d.d.

- Autorius: M Choudhry

- Leidėjas: John Wiley & Sons Inc

- Metai: 2022

- Puslapiai: 864

- ISBN-10: 1119755646

- ISBN-13: 9781119755647

- Formatas: 15.1 x 22.9 x 4.5 cm, minkšti viršeliai

- Kalba: Anglų

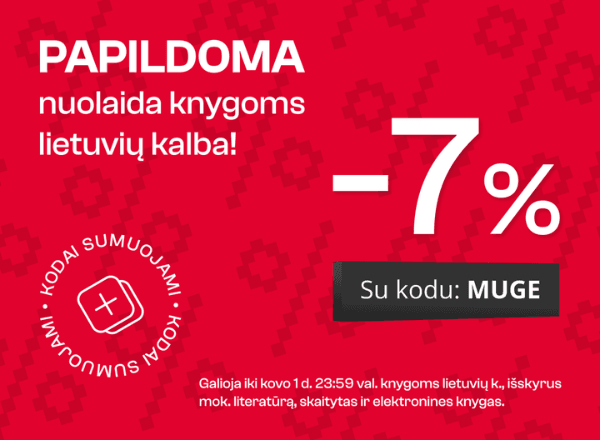

- Extra -25 % nuolaida šiai knygai su kodu: ENG25

Atsiliepimai

Aprašymas

The Principles of Banking covers essential principles of banking that serve to guide senior management towards a more sustainable business model for their banks, and regulators towards a more stable banking system. It is divided into five parts, covering the different aspects of banking principles.Part I - A primer on banking

Part II - Bank asset-liability management

Part III - Bank liquidity risk management

Part IV - Bank strategy and governance

Part V - Application software, spreadsheets and teaching aids.

Updated for new regulations since 2012 including Basel IV, The Fundamental Review of the Trading Book (FRTB), interest rate risk in the banking book (IRRBB) and Recovery / Resolution, the second edition will include the following new chapters:

Market Risk Management: Interest Rate Risk in the Banking Book (IRRBB) and Foreign Exchange Risk Management Credit risk policy and management Capital adequacy and liquidity adequacy stress testing regulatory submission process (ICAAP and ILAAP), including Recovery Planning process Customer service strategy and digital banking It will also touch on the impact of Covid-19 on banks, with respect to risk management practice and balance sheet management, and the global policy response around it.

EXTRA 25 % nuolaida su kodu: ENG25

Akcija baigiasi už 3d.00:37:31

Nuolaidos kodas galioja perkant nuo 5 €. Nuolaidos nesumuojamos.

- Autorius: M Choudhry

- Leidėjas: John Wiley & Sons Inc

- Metai: 2022

- Puslapiai: 864

- ISBN-10: 1119755646

- ISBN-13: 9781119755647

- Formatas: 15.1 x 22.9 x 4.5 cm, minkšti viršeliai

- Kalba: Anglų

Part I - A primer on banking

Part II - Bank asset-liability management

Part III - Bank liquidity risk management

Part IV - Bank strategy and governance

Part V - Application software, spreadsheets and teaching aids.

Updated for new regulations since 2012 including Basel IV, The Fundamental Review of the Trading Book (FRTB), interest rate risk in the banking book (IRRBB) and Recovery / Resolution, the second edition will include the following new chapters:

Market Risk Management: Interest Rate Risk in the Banking Book (IRRBB) and Foreign Exchange Risk Management Credit risk policy and management Capital adequacy and liquidity adequacy stress testing regulatory submission process (ICAAP and ILAAP), including Recovery Planning process Customer service strategy and digital banking It will also touch on the impact of Covid-19 on banks, with respect to risk management practice and balance sheet management, and the global policy response around it.

Atsiliepimai